Our Services

- Home

- Our Services

We guide company formation and financial licensing in top jurisdictions. From jurisdiction selection to regulatory compliance, our experts simplify the process, ensuring smooth brokerage launch with credibility and strong foundations.

Our CRM integrates onboarding, KYC, deposits, analytics, and client communication. With full MT4/MT5 integration, brokers gain operational control, deeper client insights, and tools to build stronger trader relationships

We integrate secure payment solutions with multiple currencies and methods. Supporting local and international PSPs, our service enables fast deposits, smooth withdrawals, and greater client satisfaction.

We manage complete MT4/MT5 setup and administration, including server configuration, security, plugins, and backups. Ensuring stable performance and minimal downtime, we help brokers focus on client growth and business expansion.

We connect brokers to Tier-1 liquidity providers, offering competitive spreads, fast execution, and flexible margins. This ensures transparent pricing, scalability, and superior trading experiences for clients worldwide.

We offer trading platform plugins including risk tools, bonus systems, and compliance modules. These enhance broker functionality, improve efficiency, and deliver customizable trading experiences.

We deliver professional risk and dealing strategies. Covering A/B-Book models, exposure monitoring, and hedging automation, our solutions strengthen profitability, risk control, and trading conditions across global financial markets.

Our bridge solutions link MT4/MT5 with liquidity providers. Delivering advanced routing, price aggregation, and ultra-low latency execution, brokers achieve stability, efficiency, and transparent order flow management.

We ensure seamless integration between trading platforms, CRMs, liquidity providers, and PSPs. Our support eliminates delays, reduces risks, and enables a fully connected brokerage ecosystem.

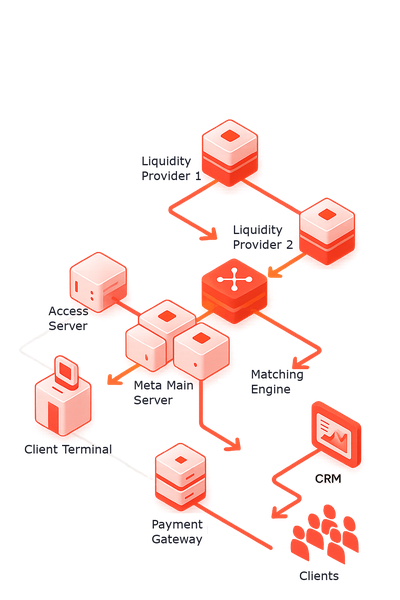

Aggregated Liquidity & Smart Routing means your orders are routed to multiple liquidity providers (LPs) simultaneously. This ensures access to deeper order books, best-price selection, tighter spreads, and fair execution with time-priority.

Our segregated Meta main server with an access layer minimizes latency and server load. This setup improves fill speed, increases platform uptime, and provides a more stable trading environment.

This means we integrate payment gateways directly with CRM systems. Clients enjoy instant deposits and withdrawals, while brokers benefit from automatic CRM updates for onboarding, KYC, compliance, and reporting.

The matching engine reduces slippage, enforces broker-side risk rules, and prioritizes fair order fills. This safeguards traders from execution delays and helps maintain trading integrity.

Yes. Our Meta Main Server combined with the Access Server is built for stability, session continuity, and DDOS-aware routing. This ensures uninterrupted trading and protection from malicious traffic.

Absolutely. The infrastructure is designed to be scalable, allowing you to expand liquidity connections, client accounts, and CRM integrations without compromising on speed or stability.

Disclaimer:

Setupbroker is an information technology and consulting firm specializing in delivering technology and operational solutions for forex brokers. We are not a financial institution, do not provide trading services, and do not accept or manage deposits, investments, or funds from clients or third parties.

Legal:

Setupbroker operate exclusively as an information technology service provider and do not promote or recommend brokerage services to clients. Our offerings are not available in sanctioned or restricted jurisdictions, including but not limited to Afghanistan, Belarus, Cuba, Iran, North Korea, Russia, Syria, Ukraine, Vietnam, Indonesia, Malaysia, and Singapore.

© Technologies For Brokers | All rights reserved 2025